Modi Cabinet Greenlights Royalty Rates for Key Mining Minerals: Lithium, Niobium, and Rare Earth Elements (REEs)

In a landmark decision, the Union Cabinet, under the leadership of Prime Minister Narendra Modi, has approved the amendment of the Second Schedule of the Mines and Minerals (Development and Regulation) Act, 1957, commonly known as the MMDR Act. This significant move aims to determine royalty rates for three critical and strategic minerals: Lithium, Niobium, and Rare Earth Elements (REEs).

The recent passage of the Mines and Minerals (Development and Regulation) Amendment Act in 2023, which came into effect on August 17th, 2023, set the stage for this pivotal development. Among its key provisions, the amendment delisted six minerals, including Lithium and Niobium, from the category of atomic minerals, paving the way for private sector concessions through auctions. Additionally, the amendment specified that the Central Government would auction mining leases and composite licenses for 24 critical and strategic minerals listed in Part D of the First Schedule of the Act, which notably include Lithium, Niobium, and REEs, excluding Uranium and Thorium.

Today’s approval by the Union Cabinet to specify royalty rates marks a historic milestone, as it opens the door for the Central Government to auction mining blocks for Lithium, Niobium, and REEs for the first time in India. The royalty rate plays a pivotal role in the financial considerations for bidders participating in block auctions. Furthermore, the Ministry of Mines has prepared a method for calculating the Average Sale Price (ASP) of these minerals, which will facilitate the determination of bid parameters.

The Second Schedule of the MMDR Act outlines royalty rates for various minerals. Item No. 55 of the Second Schedule establishes that the royalty rate for minerals not specifically provided therein shall be set at 12% of the Average Sale Price (ASP). Consequently, in the absence of specific royalty rates for Lithium, Niobium, and REEs, the default rate would have been a relatively high 12% of the ASP, a rate that diverges significantly from those of other critical and strategic minerals worldwide. In light of this, it has been decided to specify more reasonable royalty rates for these vital minerals:

- Lithium – 3% of the London Metal Exchange price.

- Niobium – 3% of the Average Sale Price (applicable to both primary and secondary sources).

- REE – 1% of the Average Sale Price of Rare Earth Oxide.

These critical minerals have gained immense importance in the context of India’s commitment to energy transition and its aspiration to achieve net-zero emissions by 2070. Lithium, Niobium, and REEs have also emerged as strategic elements due to their diverse applications and the evolving geopolitical landscape. Encouraging domestic mining of these minerals is expected to reduce imports, foster the development of related industries and infrastructure projects, and contribute to increased employment in the mining sector.

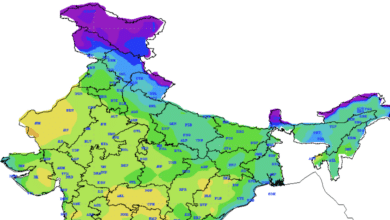

The Geological Survey of India (GSI) recently submitted an exploration report for REE and Lithium blocks, while various exploration agencies, including GSI, continue to investigate critical and strategic minerals across the country. The Central Government is actively working to launch the initial phase of auctions for critical and strategic minerals such as Lithium, REE, Nickel, Platinum Group of Elements, Potash, Glauconite, Phosphorite, Graphite, Molybdenum, and more in the near future.