8 Years of PMJJBY, PMSBY and APY: Providing Social Security Cover to Millions of Indians

Finance Minister Nirmala Sitharaman says the three Jan Suraksha schemes devoted to well-being of citizens, and safeguards human life against unforeseen risks, losses, and financial uncertainties

Pradhan Mantri Suraksha Bima Yojana (PMJJBY), Pradhan Mantri Jeevan Jyoti Bima Yojana (PMSBY), and Atal Pension Yojana (APY) have successfully completed 8 years of providing social security cover to millions of Indians. These schemes have played a crucial role in safeguarding human life against unforeseen risks, losses, and financial uncertainties. The Union Finance Minister, Nirmala Sitharaman, emphasised that the government is committed to providing essential financial services to individuals from underprivileged backgrounds and reducing their financial vulnerability.

The PMJJBY and PMSBY were launched to ensure financial security for people from the unorganised section of the country. The APY, on the other hand, provides financial coverage to people in their old age. As of 26th April 2023, there have been more than 16.2 crore, 34.2 crore, and 5.2 crore enrolments under the PMJJBY, PMSBY, and APY schemes, respectively. PMJJBY has provided crucial support to 6.64 lakh families who received claims worth Rs. 13,290 crore, while more than 1.15 lakh families have received claims for Rs. 2,302 crore under the PMSBY scheme.

The government has adopted a targeted approach to cover people in rural areas, and campaigns are being organised throughout the country for providing coverage to eligible beneficiaries under the scheme. On this occasion, Union Minister of State for Finance, Dr Bhagwat Kisanrao Karad, congratulated all field level functionaries for making these Jan Suraksha schemes popular and urged them to further enhance their coverage.

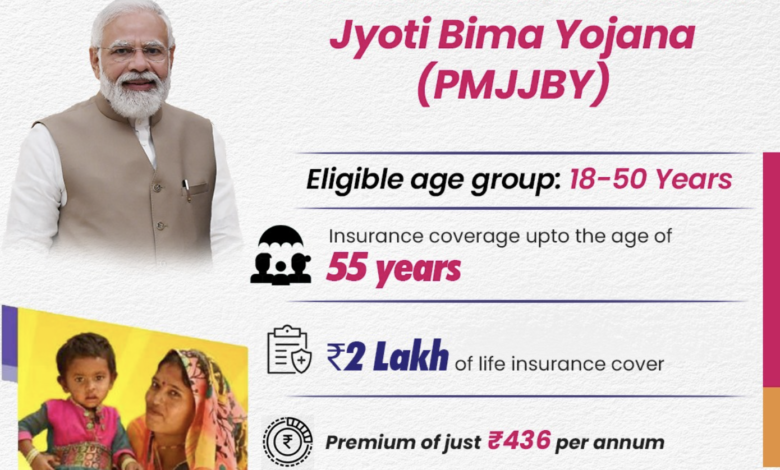

PMJJBY is a one-year life insurance scheme renewable from year to year offering coverage for death due to any reason, while PMSBY offers a life cover of Rs. 2 Lakh in case of death due to any reason against a premium of Rs. 436/- per annum. APY, on the other hand, provides a pension to the subscriber starting at the age of 60 years. These schemes have enabled affordable insurance and security to people (Jan Suraksha), their achievements, and salient features.

In conclusion, the PMJJBY, PMSBY, and APY schemes have enabled financial inclusion and social security to millions of people in India. The government is committed to ensuring that the advantages of these social security schemes reach every eligible individual across the nation.